Introduction

These Website Standard Terms and Conditions written on this webpage shall manage your use of our website, Bitcoin UP accessible at https://bitcoinup.com.

These Terms will be applied fully and affect to your use of this Website. By using this Website, you agreed to accept all terms and conditions written in here. You must not use this Website if you disagree with any of these Website Standard Terms and Conditions.

Intellectual Property Rights

Other than the content you own, under these Terms, Bitcoin UP and/or its licensors own all the intellectual property rights and materials contained in this Website.

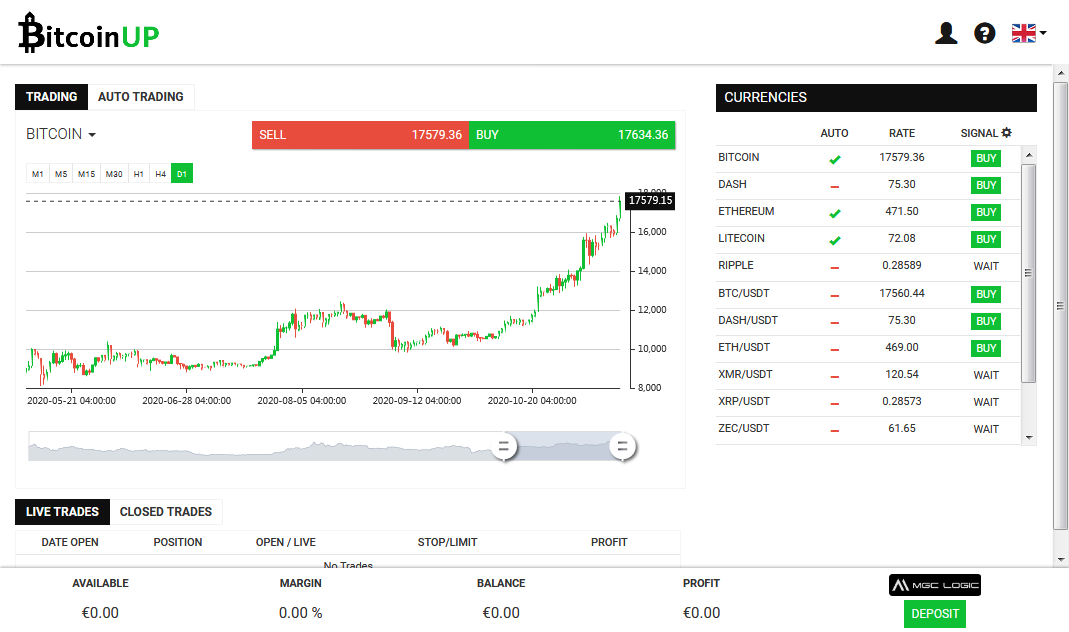

You are granted an access only for purposes of viewing the material contained on this Website in particular the use of the software/application Bitcoin UP accessible at https://bitcoinup.com/app/.

Restrictions

You are specifically restricted from all of the following:

- publishing any Website material in any other media;

- selling, sublicense and/or otherwise commercializing any Website material;

- publicly performing and/or showing any Website material;

- using this Website in any way that is or may be damaging to this Website;

- using this Website in any way that impacts user access to this Website;

- using this Website contrary to applicable laws and regulations, or in any way may cause harm to the Website, or to any person or business entity;

- engaging in any data mining, data harvesting, data extracting or any other similar activity in relation to this Website;

Certain areas of this Website are restricted from being access by you and Bitcoin UP may further restrict access by you to any areas of this Website, at any time, in absolute discretion. Any user ID, email and password you may have for this Website are confidential and you must maintain confidentiality as well.

Your Content

In these Website Standard Terms and Conditions, "Your Content" shall mean your account data with Bitcoin UP, "Your Content TP" shall mean your accounts at the third party partners that are connected to Bitcoin UP.

By registering on Bitcoin UP with "Your Content", you grant Bitcoin UP access to "Your Content", you grant Bitcoin UP copy/transfer of "Your Content" to one of the third party partners.

By your activity on Bitcoin UP, you grant Bitcoin UP access to "Your Content TP", you request/authorize Bitcoin UP to reproduce/act on your "Your Content TP".

Bitcoin UP is granted by nature access at any time to "Your Content", whereas access to "Your Content TP" is granted only by you when you are connected to Bitcoin UP at https://bitcoinup.com/app/

"Your Content" can be removed at any time via Bitcoin UP interface. "Your Content TP" can be removed via the concerned third party partner website. Bitcoin UP reserves the right to remove any of Your Content at any time without notice.

No warranties

This Website is provided "as is," with all faults, and Bitcoin UP express no representations or warranties, of any kind related to this Website or the materials contained on this Website. Also, nothing contained on this Website shall be interpreted as advising you.

Limitation of liability

In no event shall Bitcoin UP, nor any of its officers, directors and employees, shall be held liable for anything arising out of or in any way connected with your use of this Website whether such liability is under contract. Bitcoin UP, including its officers, directors and employees shall not be held liable for any indirect, consequential or special liability arising out of or in any way related to your use of this Website.

Indemnification

You hereby indemnify to the fullest extent Bitcoin UP from and against any and/or all liabilities, costs, demands, causes of action, damages and expenses arising in any way related to your breach of any of the provisions of these Terms.

Severability

If any provision of these Terms is found to be invalid under any applicable law, such provisions shall be deleted without affecting the remaining provisions herein.

Variation of Terms

Bitcoin UP is permitted to revise these Terms at any time as it sees fit, and by using this Website you are expected to review these Terms on a regular basis.

Assignment

The Bitcoin UP is allowed to assign, transfer, and subcontract its rights and/or obligations under these Terms without any notification. However, you are not allowed to assign, transfer, or subcontract any of your rights and/or obligations under these Terms.

Entire Agreement

These Terms constitute the entire agreement between Bitcoin UP and you in relation to your use of this Website, and supersede all prior agreements and understandings.

Restricted Countries

Bitcoin UP access is restricted to residents of those countries: Afghanistan, Algeria, Belgium, Chad, France, Iran, Iraq, Israel, Korea, Libya, Mali, Morocco, Palestine, Syria, Tunisia, United States, Yemen

Governing Law & Jurisdiction

These Terms will be governed by and interpreted in accordance with the law, and you submit to the non-exclusive jurisdiction of the state and federal courts located in your country for the resolution of any disputes.